Destination XL Group

Making it big

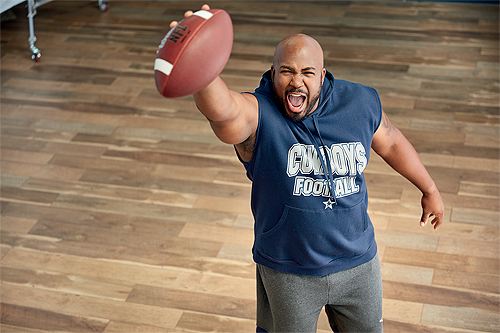

In the midst of a digital transformation designed to better fit consumer buying behavior, Destination XL Group continues to find ways to serve and support its valued Big+Tall clothing customers

Passionate about the often underserved Big+Tall clothing market, Destination XL (DXL) has been changing the lives of its customers since 1976. Boasting a presence in every major metropolitan area in the US, DXL is not only the most dominant XL specialty retailer in the nation, but a company with a reputation for creating highly personalized experiences unavailable to big and tall men anywhere else on the market. In conversation with Retail Merchandiser, CEO Harvey Kanter begins by recounting one of many transformative encounters he has witnessed since joining DXL in 2019.

“Not long after I came onboard at DXL, a customer came into one of our stores just like any other day,” Harvey recalls. “It transpired that someone had told him about us, or he’d just happened to stumble upon us, but either way, he was a real example of this underserved consumer who hasn’t had great shopping experiences elsewhere and felt intimated, or embarrassed, to shop for clothes.

“This particular customer told us he was going to a wedding, but he’d never bought a suit before because he didn’t think it would make him look or feel good. Our style and fit experts jumped into action – measuring him, asking him about the colors and styles he liked, and then eventually brought him several different outfits to try on. Minutes later, when he came out of the fitting room wearing the suit, the man looked in the COMmirror. There were tears in his eyes, and he mouthed the words, ‘I never thought I could look so good.’

“That’s the kind of meaningful difference we make with our work at DXL,” Harvey declares. “We have a real passion and respect for this market and for our customers, and that carries right through to our stores and our corporate office.”

With thousands of styles and sizing options available, from private label goods to exclusive offerings from high-end designer brands like Polo Ralph Lauren, Lacoste and Levi’s, DXL merchandise benefits from unique specifications, ensuring the best fit possible, whatever the size. Harvey explains more: “Many retailers take what is an XL garment and just ‘grade it up’ for bigger customers in the XXL range and beyond,” he says. “At DXL, we don’t do that. We create a spec that’s unique for each size. An XXXL shirt, for example, will have different collars, sleeves, cuffs and tail relative to a regular size of the same item. Perhaps the greatest appreciation of that is in our tailored pant, of which we have 72 sizes, each with a unique spec from the seat to the leg. That attention to detail, and the more bespoke product range it leads to, is probably the greatest single element that differentiates us from other retailers.”

Digital focus

As a highly customer-focused organization, DXL has, in the last two years, undergone a major digital transformation to better fit changing consumer buying habits. Back in 2018, around 20 per cent of the company’s business was derived digitally. Today, following the transformation, online penetration has more than doubled and in the fourth quarter of 2020 was at 41.4 per cent.

“Our expectations,” Harvey notes, “which we have publicly communicated, are to be 35 per cent digitally penetrative or more, in spite of getting our stores really working again and driving revenue after Covid-19. Due to the current climate, and contemporary buying habits, we believe that our digital business will grow materially faster than our stores.

“Obviously, a more digitally-focused business helped us through the Covid-19 pandemic, but it’s about more than that for us; we are evolving our approach from thinking about channels first to thinking about customers first. We are living in a time of experimentation and we don’t want to dictate how the customer chooses to engage with us – we just want to be there with a mechanism they are most comfortable with, whether that be our website, an app, delivery, in stores or through store curbside pick-up, or, our most recent innovation, interactive shopping, through a test we are currently running.”

As the name suggests, interactive shopping will allow DXL customers to interact and make purchases directly with in-store sales consultants via a live video link. The initiative is yet another example of how DXL is creating some of the industry’s most tailored shopping experiences. As Harvey puts it, “It is as if each individual customer is being marketed to uniquely. Of course, that is impossible, but by marketing to segments of customers with similar characteristics, we can deliver a similar result.”

Multi-channel offer

The specialist, individualized marketing process that Harvey describes is driven by huge amounts of data captured and leveraged by DXL. When used effectively, this data has the power to create a significantly better understanding of the unique characteristics that make each of the company’s customers different. This can then be used to tailor, and ultimately improve, consumer experiences.

“We continuously create a better understanding of our customers based on implicit and explicit signals along with buying behavior,” reveals Ujjwal Dhoot, Chief Marketing Officer at DXL. “What a customer does or often times doesn’t do is an indication of the consumer segment they fall into, and informs us on how to personalize their experience, across the web, in-store and on our app.”

Though DXL’s digital platform continues to evolve at a rapid pace, the company will not, at the same time, be neglecting its physical stores. Viewed – alongside its website and app – as an important part of DXL’s offering, traditional stores play a key role in the company’s multi-channel retail mix.

“A customer that shops across channels has a far richer, more revenue-generating relationship with us than one that only shops in-store or online,” claims Peter Stratton, the company’s Chief Financial Officer. “Our stores remain vital not only as a point of sale, but as a marketing vehicle advertising our products when someone drives by.

“The retail mix is like a flywheel,” Peter adds. “A customer comes into a store and shops; they need something else when they get home, so they go online and they shop; they are reminded of us next time they pass the store, so they go in-store and they shop. It’s circular, and that relationship is really important.”

Customer service

With over 300 mini-warehouse-style stores to its name, all capable of shipping directly from store, DXL designs its sites specifically for big and tall customers, including features like wider aisles and larger fitting rooms. Naturally, the Covid-19 pandemic, along with the growing digital market, may result in a minor rationalization of the company’s store portfolio in the near-future, but DXL’s belief in a connected network of in-store and online retail platforms means that, ultimately, there may be opportunities for the retailer to open even more stores in selective markets in the years ahead.

DXL’s transformation from a traditional brick and mortar retailer to a modern consumer brand focused on data, analytics, COMtest and control, predictive elements and digital marketing has, understandably, been the largest factor behind the retailer’s recent growth. However, it is only by staying true to its values and ethos that the company has remained popular with its loyal customer base, so, consequently, efforts to ensure that this culture persists within the business are ongoing.

“One of the things of which I am most proud is a program we have at DXL called Normalizing the Brand,” Harvey reports. “It’s really about unconscious bias and the wider elements behind discrimination. It is at the core of what we do because DXL has become successful through stores built on inclusion.”

Another benefit unique to physical stores – at least until the practice of interactive shopping becomes widespread – is people. As a retailer serving a diverse range of customers, DXL employs a similarly diverse workforce, all of whom are trained not only in how to measure and fit clothing, but also in the inclusive culture that makes the company great.

“All in all, there are three key elements to the people side of our business: culture, how we recruit and train, and the passion our consultants have for the customer,” Harvey states. “People are critical to what we do and I’m proud to work with so many people that care. We all honor the opportunity to serve and interact with our consumer, and we believe there is a meaningful opportunity to grow our business based on that.”

Planned improvements

The rapport between company and customer that Harvey alludes to means that DXL currently holds a Net Promoter Score (NPS) well above the industry average. A measure of consumer satisfaction and loyalty, NPS indicates a company’s ability to make brand advocates of its customers. With an NPS score in the high 70s, DXL’s focus on consumer engagement and personalization means customers continue to recommend the brand to others.

“We now want to raise the bar on brand advocacy even higher,” Harvey asserts. “Whether you are an airline, hotel, retailer or car repair business, customer advocacy is the best way to create awareness of your company and acquire new customers. It beats traditional advertising hands down.

“In the next three to five years, we have plans to further improve our Net Promoter Score to above 80. Through that process and improved loyalty, our customer base will grow as we become more recognized as a great business. That, in turn, will create more revenue, and with that revenue growth, more profitability.”

In 2021, the addressable Big+Tall clothing market is worth more than $10 billion. At present, DXL turns over close to $500 million pre-pandemic, which, though an incredible achievement in itself, gives the company around five per cent market share for the sector – a fact that Harvey would like to change over the course of the next decade.

“The addressable big and tall market is meaningfully greater than our revenue, despite the fact that we are the biggest specialty player in the US,” Harvey affirms. “Our belief is still that there is an underserved consumer out there, and we can do better in acquiring new customers and encouraging our existing customers COMto return. Unfortunately, given the strife of some retailers during the pandemic, we also plan to take a share of the market there as a result. In short, we while we have not authored a specific financial target going forward, executing on all the things we’ve talked about – including one to one marketing, the digital transformation, the fit and all these variables – then there is a definitive opportunity for us to grow revenue and profits.”

www.dxl.com